- Insurance Services

- Auto, Home & Personal Insurance

- Business Insurance

- Business Interruption Insurance

- Business Owners Package Insurance

- Commercial Auto Insurance

- Commercial Property Insurance

- Commercial Umbrella Insurance

- General Liability Insurance

- Hotel & Motel Hospitality Insurance

- Professional Liability (E&O) Insurance

- Surety Bonds

- Workers' Compensation Insurance

- - View All Business

- Life Insurance

- About

- Policy Service

- Contact

Does My Homeowners Insurance Cover Internal Damage?

Article originally posted on www.insuranceneighbor.com(opens in new tab)

When they think of homeowners insurance, many people have fires, storms, and natural disasters in mind. But what about internal damage, such as water leaks and mold? Are these problems covered? Your policy is likely to cover certain types of internal damage, but not all. Our knowledgeable agency will be happy to review your homeowners insurance policy and ensure you are covered for any eventuality.

What About Water Damage To My Home?

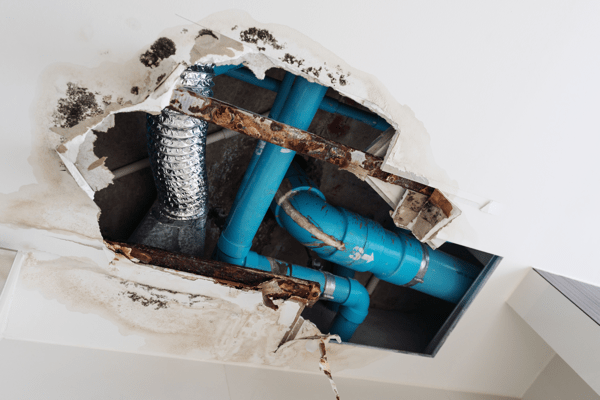

Whether a standard homeowners policy will cover internal water damage depends on how the damage occurred. If it is sudden water damage resulting, for example, from a burst pipe, wind-driven rain, or malicious criminal activities, it is likely that your policy will cover it. However, it will not cover damage caused by gradual leaks, sewage backup, or flooding. Water damage caused by discharge from a dishwasher, washing machine, or other appliance is likely to be covered, although repair or replacement of the appliance may be excluded.

Is Mold Covered Under Homeowners Insurance?

Mold in your home may or may not be covered, depending on what caused it. Mold that results from some types of water damage should be covered under you homeowner’s insurance. Removal of mold from your home is not covered if the mold resulted from flooding, ground seepage, or pipes that were poorly maintained, leading to leaks. Mold infestations that occur because of lack of maintenance or neglect are generally not covered under a homeowners insurance policy. If there is a fire in your home and the sprinklers are activated, or firefighters use water to extinguish the flames, any resulting water damage or mold should be covered.

Will My Homeowners Policy Cover Pet Damage?

Typically, homeowners insurance will not cover damage your pet does to your personal property or your home. Most homeowners policies exclude damage caused by a pet or domestic animal (and insects and rodents, as well) to the structures on your property or your personal belongings. However, liability coverage included in most standard homeowners policies may provide protection in case your animal damages someone else’s property, provided the animal is a pet or used for a hobby, such as horseback riding. Business farming animals would be excluded.

What Factors Affect The Cost Of Homeowners Insurance?

A home is one of the largest investments most of us make. In addition to being required by lenders, homeowners insurance is necessary to protect that investment. Critical factors affecting the price of a homeowners policy include:

- How much coverage you choose to purchase

- Area where your home is located

- Age, condition, and materials of the home

- Frequency of past claims

- Your credit score

- Deductible amount

- Safeguards against fire and crime

You will want to ensure you have the coverage you need while keeping your premium costs to a minimum. Our agency can help you find a homeowners insurance policy that suits your needs at the best available rates.

Filed Under: Personal Insurance | Tagged With: Homeowners Insurance